A bank is a type of financial institution that offers various services to its customers like withdrawal and deposit of money, offer loans, credit cards, debit cards, ATM services, etc. Everyday bank receives money in the form of deposits, loan payments, etc. However, not all the money received by a bank is a form of cash. Banks receive funds, from checks, direct deposits, online transfers, etc. If the bank has lots of funds left at the end of banking hours, then the bank keeps the cash in its vaults or deposits the funds in its account at the Federal Central Bank.

Definition of Bank

A bank is a government-licensed financial institute that can receive a deposit from the customers and offer loans. If you have a bank account then you can save, borrow or accrue more money from the bank through your bank account. Apart from depositing and withdrawing money, the bank also offers other types of services like check-cashing, check-issuing, credit or debit cards, insurances, etc. Banks have a very important role in the economic development of a country. Every country has a central banking system/Federal Reserve that monitors all the banks. Usually, banks keep their money in Federal Reserve.

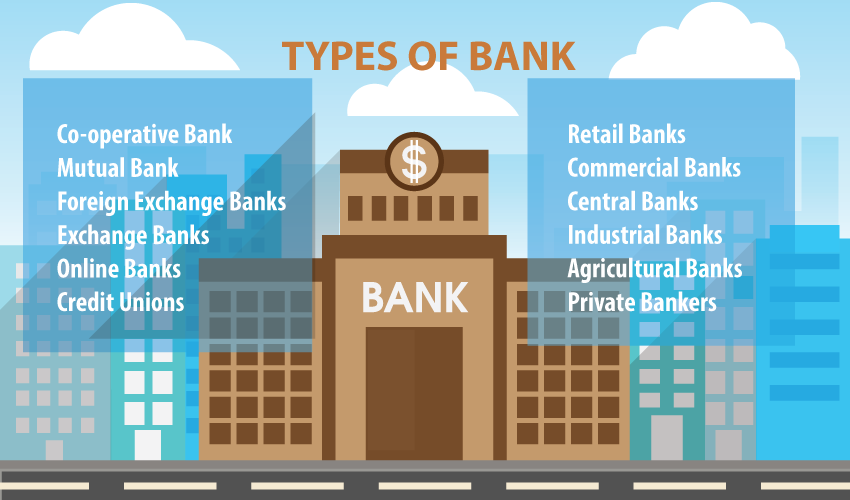

Types of Banks

Banks are available in various types. Some common types of banks are –

- Central Banks: This type of bank manages the monetary policy of a country. Federal Reserve System is the central bank of the USA and other banks in the USA can deposit money in this bank.

- Retail Banks: These types of banks are also known as consumer banks and they offer various banking services to common people. Retail banks usually offer checking accounts, savings accounts, and retirement accounts.

- Commercial Banks: This type of bank offers services to corporate, nonprofit, and government clients. This is why these types of banks are known as commercial banks. This type of bank offers special financing and loan products for businesses.

- Community Development Bank: This type of bank is also known as a Community bank or CD and they are privately owned banks. Community banks offer services on social responsibility and receive support from the government.

- Investment Bank: This type of bank doesn’t lend money, instead they invest their own money or clients’ money to make a profit. This type of bank helps the clients with mergers and acquisitions. Investment banks also help private companies go public via an initial public offering.

- Online Banks: These types of banks don’t have any physical locations but they offer all types of banking services that a conventional bank offers. You can do banking transactions online via a website or mobile app.

List of Services Offered by a Bank

Banks provide various financial services and some of the key services are –

- Certificates of Deposit: This is a type of financial product where the bank pays a fixed interest rate when the customer makes a deposit.

- Checking and Savings Accounts: Both checking and savings account allows the customers to deposit and withdraw money. Savings accounts are best for saving money while checking accounts are used for daily transactions.

- Credit Cards: Banks offer various types of credit cards that allow credit card users purchase without paying cash.

- Loans: Banks offer various types of loans to individuals or businesses and help them make a large purchase or expand their business.

- Money Market Accounts: This type of service offers debit card transactions for checking accounts.

- Safe Deposit Boxes: Many banks offer safe deposit box services like a bank vault where you can safely store valuable products like jewelry important documents, etc.

Where Banks Keep their Money?

Usually, banks keep enough money in their vault to meet their daily needs of the bank. The bank authority deposits the rest of the money in the central bank for future use. Banks don’t keep your money when you deposit your money in the bank. Because in a bank people are depositing and withdrawing money. So, if you deposit money, the bank then gives the money to other customers who are withdrawing.

This is how the daily banking activity goes on. Banks keep at least 10% of all the deposits because some people withdraw a large amount of money at a time. If the bank doesn’t keep some funds then they won’t be able to provide the required funds to the customers. Moreover, banks also keep money in their ATM so that people can withdraw money from the machine. Then banks store the rest of the money at the Federal Reserve Bank.

FAQs about Where Do Banks Keep all the Money

How much money is in the average bank vault?

On average, a USA bank vault can hold about $75 billion. Among the banks, Bank of America, Wells Fargo, JPMorgan Chase, and Citigroup have the most money in their vault.

Do banks still have vaults?

Yes, modern banks also have vaults. They keep the cash in the vaults. Apart from the vaults, modern banks also have safe deposit boxes, teller cash drawers, etc.

Can you keep millions in the bank?

Yes, you can deposit millions in the bank. In fact, banks don’t have any limit on deposit amounts. You can deposit any amount of money in your bank account.

Can you withdraw a million dollars from the bank?

Yes, you can withdraw a million dollars from the bank. However, a million-dollar is a large amount therefore, you have to notice the bank before withdrawing that amount of money. When you send a notice to the bank, the bank will arrange the fund for you.

Is it a good idea to have multiple bank accounts?

The answer to this question depends on quite a few things. With multiple bank accounts, you can separate your money and easily monitor your personal and household expenses. However, having multiple bank accounts means you have to pay more fees and charges and you also have to maintain lots of paperwork.

References:

https://www.npr.org/sections/money/2013/03/18/174619914/where-the-bank-really-keeps-your-money

https://www.investopedia.com/financial-edge/0812/5-places-to-keep-your-money-when-you-dont-trust-the-banks.aspx

Last Updated on August 7, 2022 by Ana S. Sutterfield

Magalie D. is a Diploma holder in Public Administration & Management from McGill University of Canada. She shares management tips here in MGTBlog when she has nothing to do and gets some free time after working in a multinational company at Toronto.