Negative equity occurs if the company’s liability exceeds the total asset. Negative equity is an accounting concept because the equity of a company can’t be negative. But in an accounting balance, the equity can go negative. For example, if a company’s asset is worth $90 million and if the liability is $100 million then the company’s negative equity is -10 million. Now the company can be sold at $90 million so that the investors will recover 90c from a dollar.

What is Negative Equity?

Negative equity is a type of accounting term that is not real from a financial perspective. According to various financial definitions, equity can’t be negative. However, in accounting the concept of negative equity comes because sometimes the value of assets goes below the total liability. For example, if you have borrowed some loan in exchange for a property and if the value of the property decrease rapidly then it will result in negative equity for the borrower.

The implication of Negative Equity

Negative equity can be implemented in three types of accounting scenarios –

- Negative Equity for an Asset

- Negative Shareholder Equity

- Negative Net Worth

1. Negative Equity for an Asset

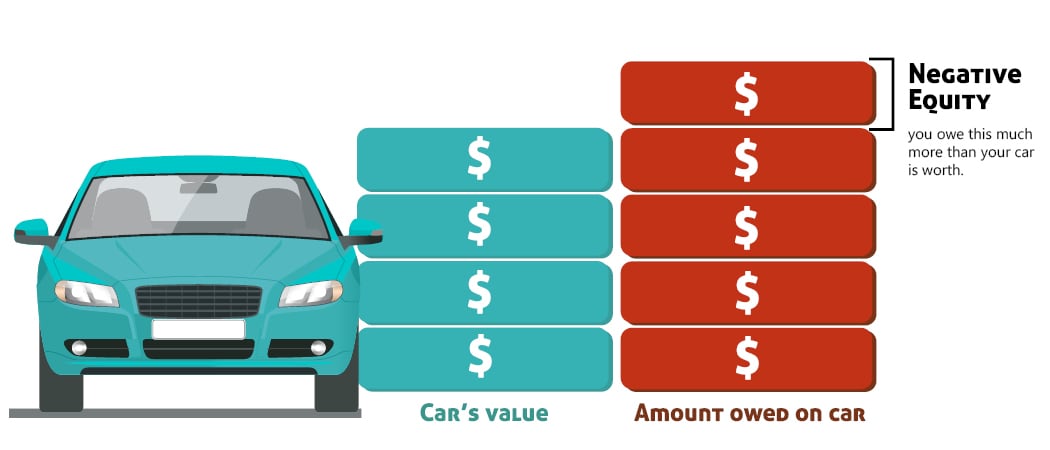

This type of negative equity is very common in the housing and automobile sector. Usually, a house or vehicle is financed by various home loans and auto loans. There are many reasons the price of a house or vehicle can reduce. If the price of mortgage assets is reduced below the debt amount then it creates negative equity.

2. Negative Shareholder Equity

The listed companies in the stock exchange can have a negative balance and this type of situation results in negative shareholder equity. A company’s balance becomes negative when the liabilities exceeded the total asset value. Negative shareholder equity is a sign of financial distress for the company.

3. Negative Net Worth

If a person’s finance has a negative worth then it is considered a negative net worth. It means the person’s liability has exceeded his total asset. For example, if you are a student and if you have a student loan then you have a negative net worth.

Closing a Negative Equity Company

Closing a company with negative equity is quite similar to closing a business with a positive balance. However, closing a company with negative equity requires certain tax implications. Below are the details of tax considerations by business structure –

Closing a C Corporation with Negative Equity: In order to close a C Corporation, you have to sell all the stocks. It will result in capital loss to the individual owners.

Closing an S Corporation with Negative Equity: When you close an S corporation with negative equity it will affect the shareholder’s finance.

Closing a Partnership with Negative Equity: You have to close a partnership business with negative equity if a partner receives liquidating distributions in excess of their basis. In this type of situation, the value of the stocks is distributed among the individual owners.

Detail Steps of Closing a Negative Equity Company

- First, you have to break the business structure by arranging meetings and votes to obtain approval

- Next, you have to File Articles of Dissolution and notify the state that the company is ending its existence

- Then you have to collect all the outstanding accounts from the customers

- If there are assets of the company, then you have to sell all the available assets; the assets include:

- Trade name

- Customer lists

- Licensing agreements

- Patents

- Copyrights

- Trademarks

- Now, pay off all the outstanding business debts and settle accounts with the vendors, suppliers, and creditors

- Then prepare payroll tax paper and submit final payroll taxes with the IRS, state and local tax agencies

- Next, you have to pay final state sales tax obligations. Without paying the state sales tax obligations, you won’t be able to close the business’s state sales tax accounts

- Then you have to file final income tax returns at the federal, state, and local levels

- After that, you have to close the company’s IRS business account and EIN

- Now, you have to cancel all the business licenses and permits

- Finally, you have to distribute the remaining funds and assets to business owners and close the business

FAQs about Why Can a Company of Negative Equity be Sold

What happens if a company has negative equity?

If a company has negative equity then it is a red flag for the company, lenders, and investors. This is because, if the liabilities of the company become due then the company won’t be able to pay them and in many cases the company becomes bankrupt.

How can a company operate with negative equity?

If negative equity appears for a company then the company should try to collect new funds from investors to cover the liabilities. However, you should keep in mind that despite the new funds, existing shareholders’ equity will remain negative.

Can a company survive with negative equity?

Yes, a company with negative equity can survive but in most cases, this type of company is written off as distressed. In most cases, a negative equity company can survive 2 – 3 years and with proper funds, they also bounce back. Currently, there are more than 118 companies in the U.S. market with negative equity!

Can a company with negative equity pay dividends?

Usually, a company with negative equity can’t pay dividends. However, there is a situation when this type of company can pay a dividend. If a company with a negative dividend decided to close the operation then it can sell its assets and make dividend payments to shareholders!

References:

https://www.investopedia.com/ask/answers/08/negative-shareholder-equity.asp

https://smallbusiness.chron.com/difference-between-insolvency-negative-equity-66732.html

Last Updated on August 7, 2022 by Ana S. Sutterfield

Magalie D. is a Diploma holder in Public Administration & Management from McGill University of Canada. She shares management tips here in MGTBlog when she has nothing to do and gets some free time after working in a multinational company at Toronto.