Stock trading or share trading is an excellent investment option to make a profit. Equity investment is quite similar to stock trading. But the main difference is when you are doing stock trading you buy or sell stocks on a stock exchange; while in equity investment you buy shares directly from companies or individual shareholders. Some common examples of equity investments are private equity investments, equity mutual funds, preferred shares, etc.

Definition of Equity Investment

Equity investment is a type of investment where you buy or sell shares directly from companies or personal investors instead of a stock exchange. This type of financial transaction allows you to get more dividends or earn more profits by selling the shares. When the value of equity investment will rise, you will earn more money from the investment. One key advantage of this type of investment is, that you become a direct part of all profits and losses of the company. So, if you are planning to directly invest in a private or a public company then equity investment is the best option for you.

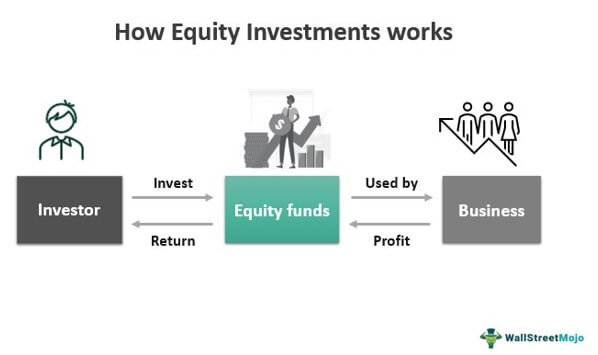

Working Procedure of Equity Investment

The main purpose of an equity investment is to become a partial owner of a private or a public company. When you invest in equity investment you make a profit when the company makes a profit. There are different types of equity investments available like preferred shares, stock options, bonds, etc. and each type has different restrictions on how the owners can share the profit.

If you want to invest in equity investment then there are many private equity investment securities available where you can invest your money. Mutual funds and ETFs are very common examples of private equity investment. You can buy a mutual fund or ETF shares and become a part of an equity investment.

How to Invest in Equities

There are quite a few ways you can invest in equities. Currently, the easiest way to invest in equities is online. There are lots of online investment platforms available where you can invest your money to buy different equities. You just have to register an account and deposit some money to start investing. Apart from that, there are three other ways available to invest in equities –

- You can invest in equities via employer-sponsored retirement accounts like 401(k) or 403(b). What type of equities you can invest in will depend on what type of provider the employee chooses.

- You can also invest in equities directly via various fund providers like Vanguard or Fidelity Investments. You should keep in mind that like the above option you will have limited investment options.

- You can open a brokerage account and directly invest in equity shares. The best part of this process is you don’t have any limitations. There might be an initial deposit requirement and the cost for this type of account varies. Therefore, you should compare the cost of different brokerage houses before opening an account.

Examples of Equity Investments

Below are some common examples of equity investments –

1. Common Shares

Shares are the most common type of equity investment and it refers to partial ownership of the company. When you buy this type of share you become the shareholder of that company. When you buy this type of share you will receive profits based on your share portions.

You can buy shares from various stock exchanges like New York Stock Exchange, etc. Hers is a list of best-performing common shares –

| Company and Ticker Symbol | Performance Year to Date |

| Occidental Petroleum (OXY) | 139.1% |

| Marathon Oil (MRO) | 91.4% |

| Coterra Energy (CTRA) | 80.7% |

| Halliburton (HAL) | 77.1% |

| APA (APA) | 74.8% |

| Valero Energy (VLO) | 72.5% |

| Devon Energy (DVN) | 70.0% |

| Hess (HES) | 66.2% |

| The Mosaic Company (MOS) | 59.5% |

| Marathon Petroleum (MPC) | 59.1% |

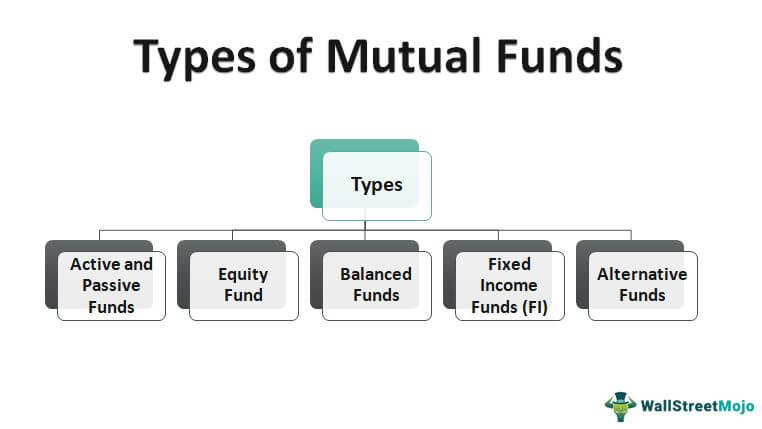

2. Equity Mutual Funds

Equity mutual funds are a type of mutual fund scheme that invests the funds in various companies’ stocks. This type of fund has various investment objective and they invest the money according to their objective. There are quite a few types of equity mutual funds available like large-cap, mid-cap, and small caps.

Market capitalization determines the type of an equity mutual fund. Some of the top-performing equity mutual funds are –

| Fund Name | Category Name | 1 year Return | 3 year Return | 5 year Return | AUM (Cr) |

| Mirae Asset Emerging Bluechip Fund – Direct Plan | Large & Mid Cap Fund | 19% | 15% | 18% | 8,218.90 |

| Mirae Asset Emerging Bluechip Fund – Regular Plan | Large & Mid Cap Fund | 17% | 14% | 17% | 8,218.90 |

| Axis Long Term Equity Fund – Direct Plan | ELSS | 22% | 16% | 14% | 20,425.31 |

| Axis Small Cap Fund – Direct Plan | Small Cap Fund | 24% | 13% | 14% | 1,037.25 |

| Sundaram Rural and Consumption Fund – Direct Plan | Sectoral/Thematic | 10% | 8% | 13% | 2,121.22 |

| IIFL Focused Equity Fund – Direct Plan | Focused Fund | 30% | 14% | 13% | 258.44 |

| Invesco India Growth Opportunities Fund – Direct Plan | Large & Mid Cap Fund | 16% | 15% | 13% | 1,821.69 |

| Axis Midcap Fund – Direct Plan | Mid Cap Fund | 17% | 15% | 13% | 3,199.73 |

| JM Multicap Fund – Direct Plan | Multi Cap Fund | 23% | 14% | 13% | 138.99 |

| Axis Long Term Equity Fund – Regular Plan | ELSS | 20% | 15% | 12% | 20,425.31 |

| Mirae Asset Tax Saver Fund – Regular Plan | ELSS | 17% | 16% | 12% | 2,465.46 |

3. Preferred Shares

This type of share is quite similar to common shares with the difference that preferred shares don’t have voting rights. In this type of share, the dividends are paid annually.

The best part of this type of equity share is, that if the company fails to pay the dividend then it will pay a cumulative amount. Some of the top-performing preferred shares of 2022 are –

- Compass Diversified Holdings 7.25% Series A Perpetual Preferred Shares (NYSE: CODI.PRA)

- Landmark Infrastructure Partners LP Series A Cumulative Redeemable Perpetual Preferred Units (Nasdaq: LMRKP)

- Energy Transfer Operating LP 7.625% Series D Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units (NYSE: ETP.PRD)

- Global Ship Lease Inc. 8.75% Series B Cumulative Redeemable Perpetual Preferred Shares (NYSE: GSL.PRB)

- InfraCap REIT Preferred ETF (PFFR)

- Innovative Preferred Plus Fund (IPPPX)

- Principal Capital Securities Fund (PCSFX)

- Nuveen Preferred Securities & Income Fd (NPSAX)

- Cherry Hill Mortgage Preferred A

- Global Net Lease Preferred Stocks

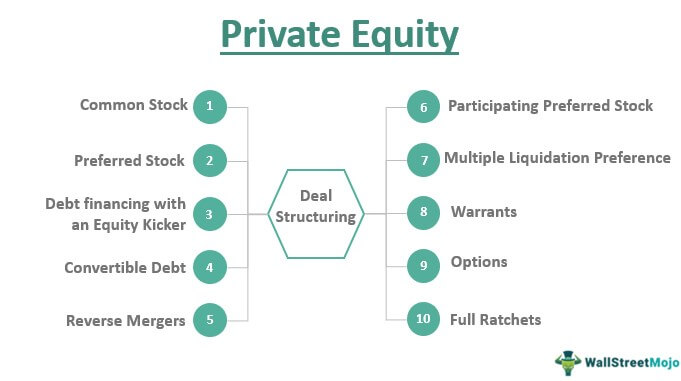

4. Private Equity Investment

You can also invest in private equity and this type of equity usually consists of capital that is not listed on public exchanges.

Usually, in private equity, investors directly invest in various companies, and these companies are not listed on any stock exchanges. Below is a list of 20 top-performing private equity funds –

- CAI Capital Partners, Canada, 3.17, 199.29,

- Falfurrias Capital Partners, US, 2.91, 401.3,

- Renovus Capital Partners, US, 2.62, 212,

- GMT Communications Partners, UK 2.02, 236.18,

- Gauge Capital, US, 1.97, 792.5,

- Detong Capital China, 1.35, 160.46,

- WindRose Health Investors, US, 1.25, 553,

- Via Equity Denmark, 1.24, 329.47

- Imperial Capital Group, Canada, 1.22, 758.1

- Vendis Capital, Belgium, 1.04, 346.98

- Seaport Capital, US, 0.89, 269.9

- Synova, UK, 0.82, 534.89

- Trinity Hunt Partners, US, 0.8, 561

- Frontenac Company, US, 0.75, 581.5

- Key Capital Partners, UK, 0.68, 138.03

- Ufenau Capital Partners, Switzerland, 0.61, 440.38

- Nippon Mirai Capital, Japan, 0.45, 291.23

- Polaris Private Equity, Denmark, 0.43, 950.7

- Cressey & Company, US, 0.42, 965

- Main Capital Partners, Netherlands, 0.41, 429.74

FAQs about What are Some Examples of Equity Investments

What are the two main types of equities?

The two main types of equities are –

- Stockholders’ equity

- Owner’s equity

What are some examples of investments?

Some common examples of investments are –

- Stocks

- Bonds

- Fixed Deposit

- Equity Investment

- Real estate investment

- Investment Trusts, etc.

What are the advantages of equity investment?

Investing money in various equities has some advantages. They are –

- You can invest in various equities and you will remain risk-free

- It is very easy to transfer equity shares

- If you invest in equities then you will be an entitlement to yearly dividends and interest

- You will gain much profit compared to common shares

What is direct equity investment?

If you purchase the ownership shares directly from the company then it will be considered a direct equity investment. Here, you won’t be able to take any help from any managers to plan how to invest and manage your portfolio. So, if you have limited knowledge about investment then it won’t be a wise decision to choose direct equity investments.

References:

https://www.blackrock.com/us/individual/education/equities

https://www.investopedia.com/terms/e/equity.asp

Last Updated on August 7, 2022 by Ana S. Sutterfield

Magalie D. is a Diploma holder in Public Administration & Management from McGill University of Canada. She shares management tips here in MGTBlog when she has nothing to do and gets some free time after working in a multinational company at Toronto.