Direct deposit is one of the fastest and most secure ways of transferring money. Direct deposit is an electronic transfer of funds between the payer’s and recipient’s accounts. It is very common that direct deposit is sent to a closed account. If it happens then there is nothing to worry about. When a direct deposit is sent to a closed account, the deposited amount will be returned to the original sender. You have to update your account information or contact with the sender about your new account information.

What is Direct Deposit and How does it Work?

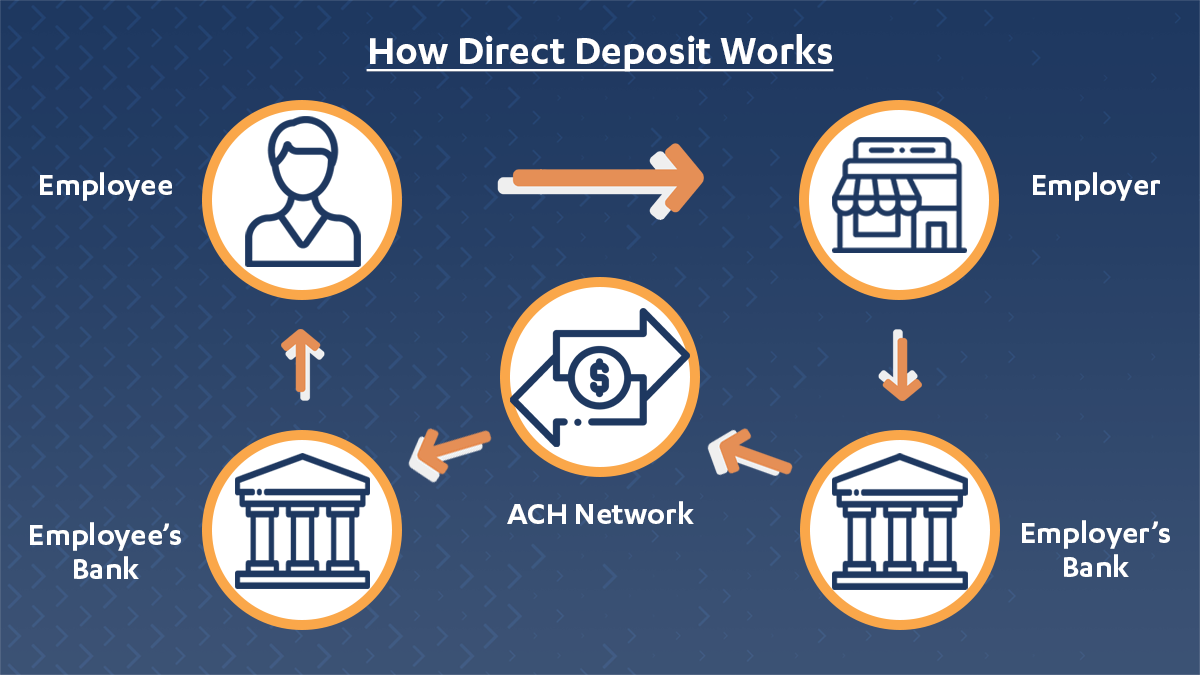

Direct deposit is a fully automated and electrical method of transferring money from one account to another. In this method, the payer issue an electronic payment instead of a paper check. Here the funds are transferred via an electronic network and the transaction takes place between two banks. The network used for direct deposit is known as an automated clearing house (ACH). Direct deposit has become very popular in the USA and almost 94% of U.S. workers receive their paychecks via direct deposit.

The working procedure of a direct deposit is quite simple. First, you have to collect all the banking information like bank account number, bank routing number, name, social security number, etc. You will need this information to initiate a direct deposit. You have to provide this information to the bank taller than the bank will forward the information to the Automated Clearing House (ACH). After that, the ACH operator will sort the ACH entries and initiate the transaction. When the receiving bank will get the instruction it will process the payment and credit the receiver’s bank account.

What Will Happen If the Direct Deposit Goes to a Closed Account?

If you send a direct deposit to a closed account then the bank will reject the transaction. Moreover, the bank will send a notification to the sender about the closed account. In this type of situation, the bank contacts the sender by mail. If the sender is reachable then the bank will reissue the payment as a one-time paper check.

If the receiver updates the account information then the bank can transfer the funds to the new bank account. However, if the sender is not reachable then the bank will hold the money for a certain time according to state law. After that time, the bank will transfer the funds to the state’s unclaimed property office.

What Happens to the Stimulus Check If Your Account Is Closed?

Stimulus Check is very popular among people because who doesn’t love free money, right? However, if your stimulus check goes to a closed account then things become complicated. So, in this type of situation, the bank authority will send the money back to the IRS. Then the bank will send you a mail about the closed bank account and the stimulus check.

When the IRS will receive the fund, they will issue a paper check to your mail. So, if your stimulus check goes to a closed account then there is nothing much to worry about. It might take 3 – 5 days but you will eventually get your money.

FAQs about What Happens to a Direct Deposit that Goes to a Closed Account

Does a direct deposit reopen a closed bank account?

No, a direct deposit to a closed bank account won’t reopen a closed bank account. You should contact the bank about their policy to reopen a closed bank account.

How Many Days for a Bank to Reject a Deposit on a Closed Account?

Usually, it takes at least 4-10 days for a bank to reject a deposit on a closed account. However, different banks have different policies regarding the direct deposit on a closed bank account. Therefore, you should contact your bank to find out their policy regarding the closed account and direct deposits.

Can funds from a direct deposit add to a closed account?

In most cases, the bank won’t add the funds from a direct deposit to a closed account. Almost all banks handle this matter in a different way. But in most cases, the money is sent back to the sender’s account.

What are the reasons people want to close their bank accounts?

There are many reasons people want to close their bank accounts. Some common reasons are –

- Bad customer service

- Personal reasons

- High-interest rates

- ATM availability

- Relocation

- Negative balance, etc.

What are the steps to set up a direct deposit?

If you want to set up a direct deposit then you can follow the below steps –

- First, you have to fill out the direct deposit form:

- Name

- Address

- Social Security number

- Signature

- Then you have to include your account information:

- Account name

- Account number

- Routing number

- After that, you have to enter the deposit amount

- Then you have to attach the voided check or deposit slip

- Finally, submit the direct deposit form to the payroll department of your office

References:

https://donotpay.com/learn/if-my-bank-account-is-closed-what-happens-to-my-direct-deposit/

https://www.westernunion.com/blog/en/us-send-money-closed-account/

Last Updated on August 7, 2022 by Ana S. Sutterfield

Magalie D. is a Diploma holder in Public Administration & Management from McGill University of Canada. She shares management tips here in MGTBlog when she has nothing to do and gets some free time after working in a multinational company at Toronto.